Business

The Best Ways to Save Your Money during a Recession

Going through a recession can be difficult for people as they are trying to make ends meet. There is not much income in comparison to the expenditure, which is normally the case that occurs in inflation.

However, you should be well aware of where you should invest your money so that you could save it as much as you can and only use it in times of need. You can invest in mutual funds online or you may even look for good ways to save online as well but for that, you would need to ensure that you have a reliable internet service.

For that matter, we would suggest that you look for internet near me and find a reliable provider with high-speed internet plans.

We have also compiled a list of ways that you can ensure you save your money in times of recession so that you could keep yourself safe from bankruptcy. Keep reading to find out what those ways are!

1. Try Making Use of a Savings Account

The first and most basic thing that you should do is to consider opening a Savings Account for yourself. As the name itself states, a savings account helps you save up money so that you don’t end up spending too much money and stay well within your budget. Another thing that you need to keep in account is that while in a recession, you might have to rely on your savings; therefore, you need to make sure that you keep a hefty amount in your savings account.

Some banks have withdrawal limits but having a savings account in itself can ensure that you have a lot of money in the bank whenever there is a time of need. On the plus side, having a savings account also gives you a percentage of interest, which means a little more for the cookie jar.

2. Try Investing in a Good Trust Fund

Another good investment is to consider investing in a good trust fund. For instance, you could consider getting Federal Bond Funds, which are made by the US Treasury Bonds. One of the main reasons for getting this bond is because it comes with no credit risk at all since the government holds the ability to levy taxes and print money, which then finishes the risk of defaulting and gives the investor a good sense of protection.

You could also consider getting bond funds in the form of mortgages since they are also secured by the Government Mortgage Association which also includes the full faith of credit of the US Government, making it a safe investment.

3. Familiarize Yourself With an Investment in a Money Market Account

A money market account gives you the perks of both a savings account and a checking account, giving you the best of both worlds. It is a lot easier to access the money that you keep in a money market account, something similar to what you can do with a checking account. A money market account also gives you a good interest rate, something you would get with a good savings account. You also get a debit card with your account and can write checks.

However, just like a savings account, you might also have a withdrawal limit on your money market account. Therefore, you need to be mindful of the limit so that you don’t end up extracting too much money out of your account.

4. Try Investing in Healthcare Related Stocks

You would probably be aware that companies that sell their shares in the stock market are usually grouped into sectors. There are 11 sectors that include communication services, energy, financials, healthcare, information, real estate, and more.

While a country goes through a recession, it is obvious that some sectors would perform better than the rest. That is because the needs of customers change accordingly and they would want to buy from sectors that they most relate to at the time. The sectors that would perform the best during the time of a recession are the healthcare sector and the consumer staples sector. A study in 2021 pointed out that even while there is a recession going on, the hiring of healthcare professionals remains constant and stable, therefore it could be said that the healthcare industry is more or less “recession-proof”.

Wrapping Up

Ever since the COVID-19 pandemic hit the world, there was a global recession as the whole world was affected from an economic perspective. Wherever you are in the world, it is important to know where it would be safe to keep your money as the world tries to struggle its way out of the recession. Be sure to keep this list in mind so that you could save your money as effectively as possible!

Also Visit: 8 Real Estate Software Solutions That’ll Be a Must in 2025

-

Celebrity1 year ago

Celebrity1 year agoWho Is Jennifer Rauchet?: All You Need To Know About Pete Hegseth’s Wife

-

Celebrity1 year ago

Celebrity1 year agoWho Is Mindy Jennings?: All You Need To Know About Ken Jennings Wife

-

Celebrity1 year ago

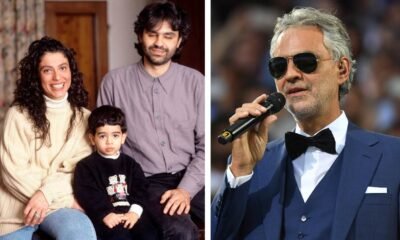

Celebrity1 year agoWho Is Enrica Cenzatti?: The Untold Story of Andrea Bocelli’s Ex-Wife

-

Celebrity1 year ago

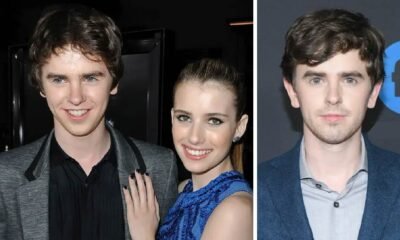

Celebrity1 year agoWho Is Klarissa Munz: The Untold Story of Freddie Highmore’s Wife