Business

Unlocking Opportunities with Corporate Bonds in Australia: A Guide by Capital Guard

Investing in corporate bonds in Australia presents a viable option for those looking to diversify their investment portfolio while aiming for a stable income stream. Corporate bonds, unlike equities, typically offer fixed interest returns and can act as a buffer against the volatility of the stock market. As investors seek to enhance their returns amidst economic fluctuations, understanding the dynamics of corporate bonds becomes crucial.

What Are Corporate Bonds?

Corporate bonds are debt securities issued by corporations to raise capital. The buyer of the bond lends money to the corporation in exchange for periodic interest payments and the return of the bond’s face value upon maturity. This form of investment is generally considered safer than stocks, particularly when issued by companies with high credit ratings.

The State of Corporate Bonds in Australia

Australia’s corporate bond market is an integral component of the country’s financial system. It offers businesses a valuable source of capital outside of traditional bank loans. As companies look for alternative financing methods, the corporate bond market is expanding, providing investors more opportunities.

Benefits of Investing in Corporate Bonds

Investors turn to corporate bonds for several reasons. Primarily, these bonds provide regular income through interest payments, known as coupon payments. Moreover, they are typically less volatile than stocks, providing a more predictable return on investment. The fixed income feature of corporate bonds is especially appealing in times of economic uncertainty.

Risks Involved

While considered a safer investment compared to equities, corporate bonds are not without risk. The primary risks include credit risk, where the issuer may default on payments, and interest rate risk, where bond prices fall as interest rates rise. Investors must assess these risks and consider the creditworthiness of the bond issuer before investing.

How to Invest in Corporate Bonds

Individual investors can purchase corporate bonds through brokers or invest in bond funds. Each method has its advantages; direct purchases allow for a more personalised investment strategy, while bond funds offer diversification and professional management.

Factors to Consider Before Investing

Several factors should be taken into account before investing in corporate bonds, including the issuer’s credit rating, interest rates, and the bond’s maturity date. Assessing these components helps investors gauge the potential return and risk associated with their investment.

Current Trends in the Australian Corporate Bond Market

Currently, the Australian corporate bond market is witnessing growth, driven by low interest rates and increasing corporate financing demands. Companies are exploring this market to fulfil capital requirements, offering diverse opportunities for investors.

Tax Implications

Investing in corporate bonds in Australia comes with specific tax implications. The interest earned on these bonds is generally considered taxable income. Investors should seek guidance from financial advisors to understand the tax obligations associated with their bond investments.

Comparing Corporate Bonds and Government Bonds

Corporate bonds usually offer higher yields than government bonds due to the increased risk associated with corporate issuers. However, government bonds are deemed safer, backed by the government’s credit. The choice between the two depends on the investor’s risk tolerance and investment goals.

Role of Credit Ratings

Credit ratings play a crucial role in assessing the risk of corporate bonds. Agencies assign ratings based on financial stability, determining the likelihood of default. Higher ratings suggest lower risk, while lower ratings indicate a higher risk but potentially higher yields.

Strategies for Managing Investment Risk

To mitigate investment risks, investors can diversify their bond holdings, invest across various sectors and credit ratings, and remain informed about economic conditions that might affect bond markets.

Technology and the Bond Market

Technological advancements are revolutionising the bond market, enhancing transparency and accessibility. Digital platforms enable investors to access extensive information and execute trades efficiently, broadening the reach of bond investments.

Conclusion

Corporate bonds in Australia present a promising avenue for investors seeking higher yields compared to traditional savings methods. With thorough research and understanding of the market dynamics, investors can unlock significant opportunities. As the Australian economy continues to evolve, the role of corporate bonds is likely to expand, offering diversified income streams and investment security.

-

Celebrity1 year ago

Celebrity1 year agoWho Is Jennifer Rauchet?: All You Need To Know About Pete Hegseth’s Wife

-

Celebrity1 year ago

Celebrity1 year agoWho Is Mindy Jennings?: All You Need To Know About Ken Jennings Wife

-

Celebrity1 year ago

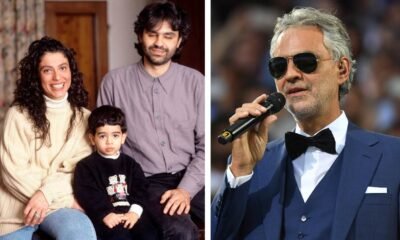

Celebrity1 year agoWho Is Enrica Cenzatti?: The Untold Story of Andrea Bocelli’s Ex-Wife

-

Celebrity1 year ago

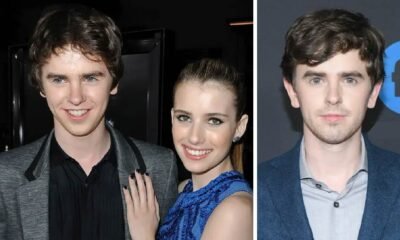

Celebrity1 year agoWho Is Klarissa Munz: The Untold Story of Freddie Highmore’s Wife