Business

Profit Isn’t a Feeling: Make It Trackable

When Gut Instinct Becomes a Guess

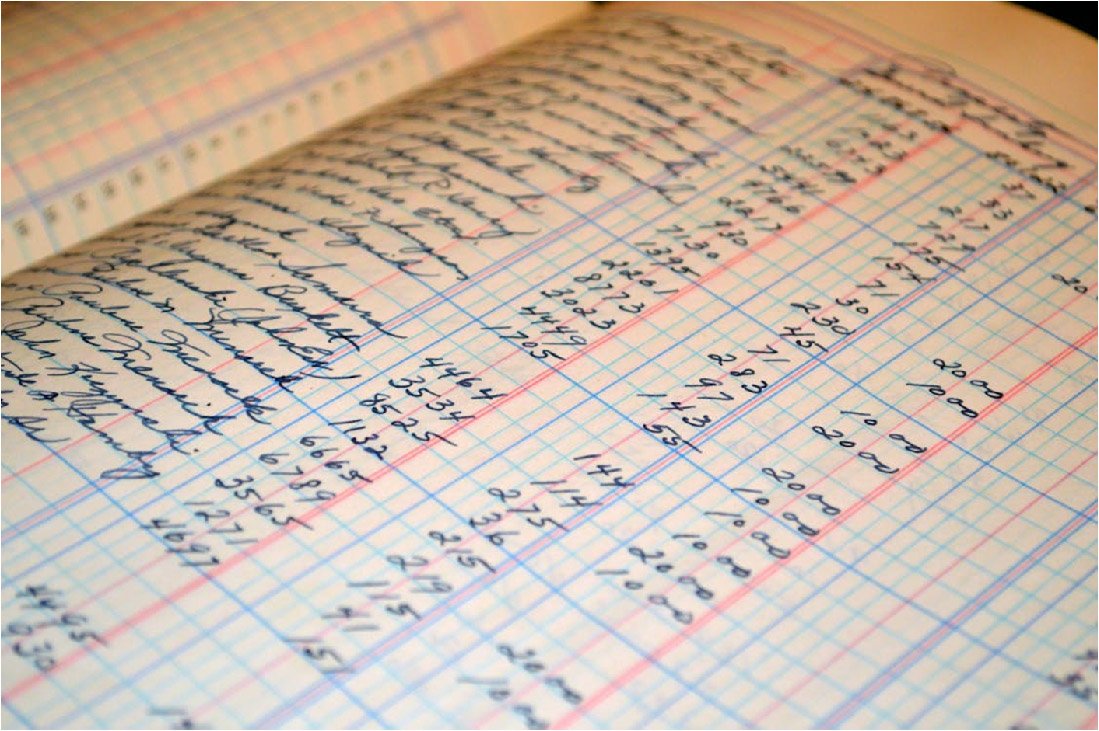

You know the feeling—you’ve had a busy month. Orders were flying in, your team was clocking overtime, your inbox didn’t stop buzzing. So you lean back, sip your coffee, and tell yourself, “We must be doing well.” But here’s the thing: profit isn’t a vibe. You can’t rely on workload or stress levels to gauge financial health. Without proper tracking, you’re basing business decisions on assumptions. And assumptions, as every seasoned entrepreneur learns, can cost you.

Via Pexels

Activity Isn’t Always Income

Just because your business is busy doesn’t mean it’s profitable. A packed calendar can hide a mess of inefficiencies. Maybe you’re undercharging. Maybe you’re absorbing hidden costs. Maybe you’re spending too much time chasing unpaid invoices instead of closing new deals.

Busy is not the same as thriving. Real profit comes from knowing what’s coming in, what’s going out, and what’s left once the dust settles.

Visibility Is the Power Move

So what does tracking profit actually look like? It’s not just logging numbers into a spreadsheet or glancing at your bank balance. It’s about building systems that show you the full picture in real time.

You need visibility into your sales, your overheads, your margins, and—perhaps most overlooked—your payment cycle. If clients are slow to pay, or your billing is inconsistent, your bottom line takes the hit. Not because your service is weak, but because your tracking is.

The Case for One Lean Tool

Let’s talk practicalities. You could hire an accountant to sit beside you all day and crunch numbers, or you could tighten the way money moves in and out of your business using smarter tools.

This is where invoicing software earns its keep. The right platform doesn’t just shoot out PDF bills—it lets you automate reminders, see who’s paid and who hasn’t, and even connect to your accounting system. It helps you stop guessing and start knowing. That kind of clarity doesn’t just save you time—it makes you money.

Stop the Leak Before It Floods

Every untracked expense, every late payment, every forgotten invoice—that’s money leaking out of your business. And if you’re not actively measuring it, you’re just hoping that the leak isn’t too big.

But hope isn’t a business strategy. Measurement is. When you put structures in place that monitor what matters—like when you get paid, how much you keep, and what trends are forming—you move from reactive to proactive.

You stop firefighting and start fine-tuning. That’s when real growth happens.

Your Numbers Should Talk Back

If your numbers don’t answer your questions—What’s working? What’s not? Where did that money go?—then they’re not helping you.

You need systems that don’t just store data, but translate it. Systems that help you see patterns, act faster, and make decisions with confidence, not guesswork. When your numbers talk back, you stop flying blind.

Final Thought

Don’t wait until tax season to figure out whether your business is healthy. Don’t let your gut feelings be the only dashboard you trust.

Make profit something you can see, not just something you sense. Track it. Understand it. Then build from there.

For More Information, Visit Coopermagazine

-

Celebrity1 year ago

Celebrity1 year agoWho Is Jennifer Rauchet?: All You Need To Know About Pete Hegseth’s Wife

-

Celebrity1 year ago

Celebrity1 year agoWho Is Mindy Jennings?: All You Need To Know About Ken Jennings Wife

-

Celebrity1 year ago

Celebrity1 year agoWho Is Enrica Cenzatti?: The Untold Story of Andrea Bocelli’s Ex-Wife

-

Celebrity2 years ago

Celebrity2 years agoWho Is Klarissa Munz: The Untold Story of Freddie Highmore’s Wife