Health

The Importance of Shopping Around for Health Insurance Quotes

Health insurance is one of the most critical investments you can make in your health and financial security. In fact, understanding your options and choosing the best health insurance plans can have a profound impact on your access to quality care and your overall peace of mind. This article will guide you through the key reasons to compare quotes and how to navigate the process effectively.

What Is Health Insurance?

Health insurance provides coverage for medical expenses, ensuring you can access the care you need without incurring prohibitive costs. It is available through public systems, like the NHS in the UK, or private providers. Private health insurance, in particular, offers benefits such as reduced waiting times, access to specialists, and a more personalized healthcare experience.

Policies vary widely. Basic plans typically cover inpatient treatments and surgeries, while more comprehensive options include outpatient services, diagnostic tests, and mental health support. Providers range from large insurers to brokers and financial advisers, giving consumers ample choice. Understanding how these policies work helps you assess whether private health insurance aligns with your healthcare needs and lifestyle.

Why Shopping Around Matters

Many people settle for the first health insurance quote they receive, unaware of the potential savings and benefits of comparing options. Shopping around allows you to find a policy tailored to your needs, often at a lower cost.

By comparing quotes, you can:

- Identify policies with better coverage options, like mental health services or physiotherapy.

- Avoid overpaying for features you don’t need.

- Discover insurers with faster claims processes or additional perks.

Investing time in research ensures you get value for your money and access to the best healthcare options available.

Key Benefits of Private Health Insurance

Shared Policies and Cost Savings

Sharing a policy with family members can reduce costs significantly. Many insurers offer discounts for joint policies, simplifying billing and ensuring comprehensive coverage for all included individuals. For young families, this can be a financially savvy choice that balances cost with quality healthcare access.

Free Coverage for Additional Children

Several insurers provide free coverage for children after the first, making private health insurance appealing to growing families. This benefit not only saves money but ensures that every family member has access to essential healthcare services without additional financial burden.

Flexible Access to Medical Services

Private health insurance often includes features like digital GP consultations and reduced wait times for treatments. These options provide flexibility and convenience, particularly for busy families juggling work, school, and personal commitments.

Peace of Mind and Emergency Support

One of the greatest advantages of private health insurance is peace of mind. Knowing you have timely access to quality medical care can reduce stress in emergencies. For instance, private policies often guarantee shorter wait times and access to specialists who provide tailored treatment plans.

In addition to emergency care, private insurance frequently covers unexpected events, such as sports injuries or urgent diagnostic tests. This reliability ensures that families can focus on recovery rather than worrying about logistics or costs. Overall, private health insurance acts as a safety net, offering reassurance in challenging times.

What Isn’t Covered?

It’s essential to understand the limitations of private health insurance to make an informed decision. Most policies exclude:

- Pre-existing conditions.

- Chronic illnesses like diabetes or hypertension.

- Cosmetic surgeries and non-essential treatments.

Additionally, certain high-risk activities or sports-related injuries might not be covered unless specified. Reviewing the exclusions ensures you’re fully aware of what the policy includes and helps you manage expectations.

Is It Worth It?

Pros of Private Health Insurance

The benefits of private health insurance are undeniable:

- Reduced waiting times for treatments.

- Access to private rooms and personalized care.

- Coverage for therapies, such as physiotherapy and specialist consultations.

For families, these advantages translate into better health outcomes and convenience, making private insurance a worthwhile investment for many.

Cons and Financial Considerations

Private health insurance can be expensive, with premiums increasing as you age. For some, the cost might outweigh the benefits, especially if you’re generally healthy or satisfied with public healthcare services. Evaluating your budget and healthcare needs is crucial to making the right decision.

How to Choose the Right Policy

Comparing Policies and Providers

Start by researching multiple providers, including insurers, brokers, and financial advisers. Use comparison websites to evaluate premiums, coverage, and additional benefits. Pay attention to customer reviews and insurer reputations for claims processing and customer service.

Customizing Coverage

Tailor your policy to your needs by adding or removing features. For example, if mental health support is crucial, ensure it’s included. Alternatively, you can reduce costs by excluding non-essential modules, such as cosmetic treatments.

Understanding Small Print

Thoroughly review policy documents to understand exclusions, limits, and claims procedures. Look for terms regarding waiting periods and out-of-network charges. Clarify any doubts with your insurer or broker before committing to a plan.

Alternatives to Private Health Insurance

Not everyone needs private health insurance. Alternatives include using savings to pay for occasional treatments or relying on public healthcare with supplemental private consultations. These options can be cost-effective for young, healthy individuals who don’t anticipate frequent medical needs.

Conclusion: Weighing the Benefits

Shopping around for health insurance quotes is an essential step toward finding the right policy. By comparing options, you can secure better coverage, save money, and access quality healthcare. For young men starting their financial journey, investing in the right health insurance policy ensures both financial security and peace of mind. Take the time to evaluate your needs and explore your options—it’s a decision that can significantly impact your future.

For More Information Visit Coopermagazine

-

Celebrity1 year ago

Celebrity1 year agoWho Is Jennifer Rauchet?: All You Need To Know About Pete Hegseth’s Wife

-

Celebrity1 year ago

Celebrity1 year agoWho Is Mindy Jennings?: All You Need To Know About Ken Jennings Wife

-

Celebrity1 year ago

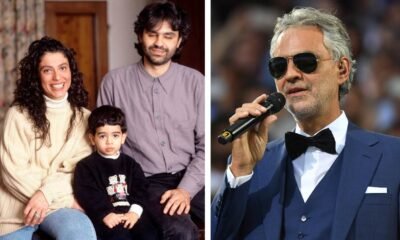

Celebrity1 year agoWho Is Enrica Cenzatti?: The Untold Story of Andrea Bocelli’s Ex-Wife

-

Celebrity1 year ago

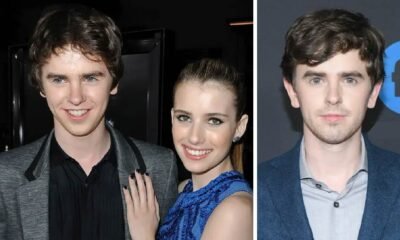

Celebrity1 year agoWho Is Klarissa Munz: The Untold Story of Freddie Highmore’s Wife